There are many reasons people develop bad credit. Divorce, health problems, job loss … bad credit happens to good people all the time. Without a reliable vehicle, getting back on your feet and improving your financial situation can be tough. Fortunately, it is possible to finance a car, even if you have bad credit. Read on to learn how to get a car loan with bad credit.

Be Realistic

Before you begin the process of looking for a car and applying for a car loan, take a long, hard look at your circumstances. Getting approved for a loan is only the first step. Once you buy a car, you will need to pay to register and insure it, maintain it, fuel it and maybe even park it. Taking into account all of these necessary expenses, even if you get approved for a loan, can you really afford a car now? The worst thing you can do is default on your loan. That will only damage your credit further.

Secure a Down Payment

If you’ve looked at your finances and concluded you can afford a car, the next step is becoming approved for a loan. Issuers of bad credit car loans place heavy emphasis on an applicant’s proposed down payment. When you’re applying for a car loan with bad credit, the more money you have available to use for a down payment, the more likely you are to be approved for a loan and the more credit you will be granted. Always put as much money down as you can afford, without stretching your budget to the limit. Even if you have to delay your purchase for a few months while you’re saving up, it’s in your best interest to come in with a solid down payment.

Understand Bad Credit Car Loans Have Higher Interest Rates

Besides being approved for a loan, a hefty down payment will help with your interest rate. Because your credit history is poor, lenders consider you high risk. As such, you will not qualify for low-interest perks and promotions. It’s a tough pill to swallow, but be aware car loans for people with bad credit come with high interest rates. Fortunately, if you make your payments on time, your credit will improve and you may be able to refinance your loan later for a more competitive interest rate.

Prepare to Pay a High Monthly Payment

Because loans for people with bad credit have higher interest rates, they have higher monthly payments. Resign yourself to the fact bad credit car loans come with high monthly payments. However, take comfort in the knowledge a bank will not approve you for more than you can afford. By making smart financial choices, you will be able to afford that monthly payment.

Understand You May Have to Choose a Less Expensive Vehicle

For people with good credit, buying a new car can be an exciting time. They do their research, test drive different makes and models and are often able to purchase their ideal car. When you have bad credit, you probably can’t afford the car of your dreams. Understand you may have to settle for an acceptable vehicle, rather than your dream vehicle. Consider that motivation to use your new car to improve your financial circumstances so you can afford the car of your dreams down the road.

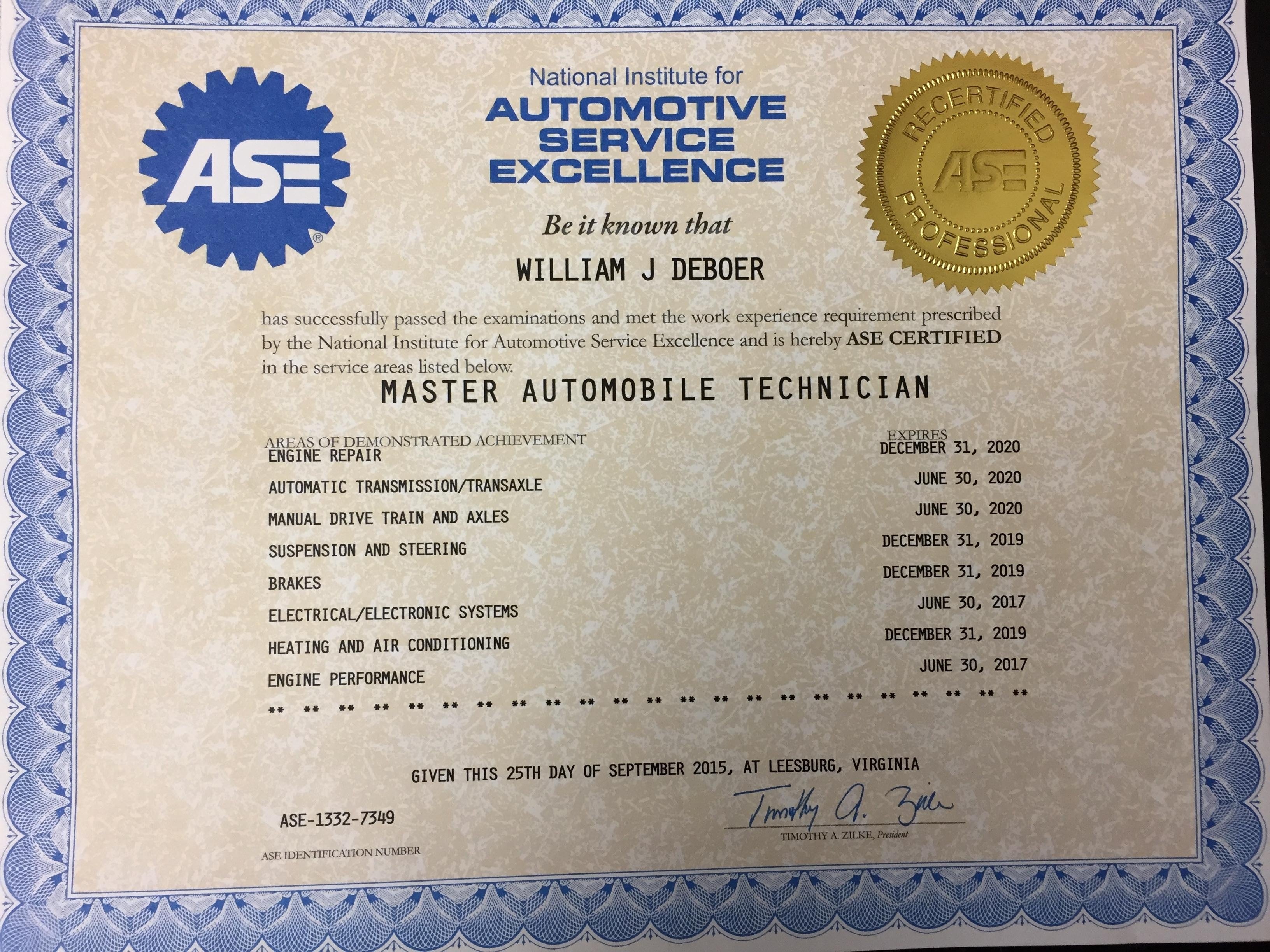

If you have poor credit but need a reliable car for work or school, we encourage you to contact us at DeBoer’s Auto Sales & Service. Our Sussex County auto dealership regularly approves loans for people with credit struggles. A vehicle can help you get back on your feet, and we’re here to assist you.